[ad_1]

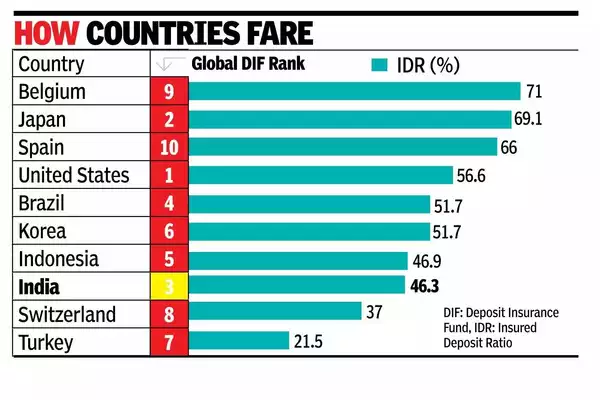

MUMBAI: India’s deposit insurance fund, close to Rs 2 lakh crore, is the third-largest globally. However, it covers only 46.3% of bank deposits due to the Rs 5 lakh cap on insurance coverage, putting it on the 8th position in terms of coverage.

According to bankers, the scheme is adequate as most deposits are with public sector banks or systemically-important banks that are unlikely to fail. A significant portion of the insured deposits are with cooperative banks, where over 90% of customers are fully covered in terms of the number of accounts held.

Last week’s moratorium on the New India Cooperative Bank by the Reserve Bank of India has once again ignited the debate on the adequate level of deposit insurance cover for bank deposits. Senior citizens are demanding a hike in the coverage reasoning that a chunk of their life savings are at stake.

There has been a call for providing a differential level of deposit insurance. In Aug 2024, RBI deputy governor M Rajeshwar Rao had called for periodic revision of premia of deposit-taking institutions with full coverage for certain segments like small deposits and senior citizens.

“We could also examine the possible economic viability of an alternate targeted insurance approach with full coverage for certain sections of the customers like small depositors, senior citizens etc. or pools deposits of smaller depositors based on a careful evaluation of the constructs, costs and benefit of such an approach,” said Rao at a DICGC event in Jaipur.

The deposit insurance ceiling started at Rs 1,500 in 1962 and was gradually increased to Rs 30,000 in 1980. It remained at that level until 1993, when it was raised to Rs 1 lakh. For 27 years, it was not revised until 2020, when it was hiked five times to Rs 5 lakh after issues at several private banks, including Yes Bank, triggered deposit withdrawals.

In terms of value, payments bank accounts have nearly 100% insurance coverage due to the Rs 2 lakh cap on deposits. Rural banks have 80.3% coverage, cooperative banks 63.2%, public sector banks 48.9%, private sector banks 32.7%, and foreign banks 5%.

Globally, the insured deposit ratio varies significantly, from a minimum of 21.5% in Turkey to a maximum of 71% in Belgium. On average, deposit insurers cover around 41% of eligible deposits worldwide, leaving 59% uninsured as of 2022.

In India, the uninsured deposits to assessable deposits ratio (UIDR) remained below 80% up to Mar 31, 2024. This aligns with the “80/20” rule, which suggests that the insured deposits ratio should be above 20% or the UIDR should be below 80%.

The UIDR was below 50% for nearly four decades from 1969 to 2009. As of Mar 31, 2024, it stood at 56.9%, comparable to the global median, according to the Deposit Insurance and Credit Guarantee Corporation’s (DICGC) annual report.

[ad_2]

Source link