[ad_1]

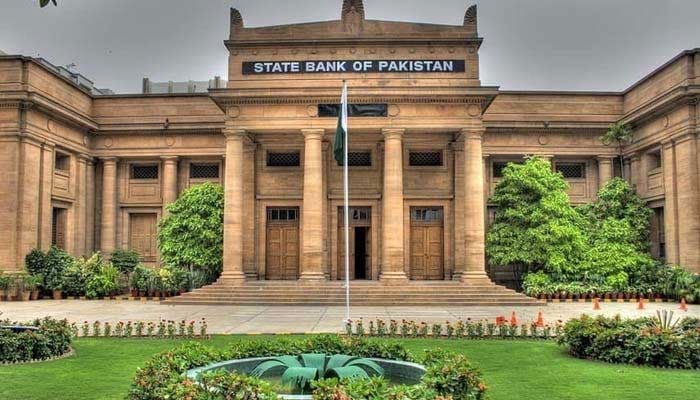

KARACHI: The Monetary Policy Committee (MPC) cut the key policy rate by 200 basis points (bps) to 13%, the State Bank of Pakistan (SBP) announced on Monday, as inflation continued to ease.

Last month, the central bank cut its key interest rate by 250bps to 15%, at least 0.5% more than the market expectations amid declining inflation.

The consumer price index (CPI) for November clocked in at 4.9% — well below the general market consensus.

The consumer price index (CPI) for November clocked in at 4.9% in line with the Monetary Policy Committee (MPC) expectations — well below the general market consensus.

“This deceleration was mainly driven by continued decline in food inflation as well as the phasing out of the impact of the hike in gas tariffs in November 2023,” noted the MPC, adding that the core inflation, at 9.7%, is proving to be sticky, whereas inflation expectations of consumers and businesses remain volatile.

The committee, which met today, also noted that the current account remained in surplus for the third consecutive month in October 2024 which helped increased the forex reserves to around $12 billion.

“Second, global commodity prices remained generally favourable, with positive spillovers on domestic inflation and the import bill. Third, credit to the private sector recorded a noticeable increase, broadly reflecting the impact of ease in financial conditions and banks’ efforts to meet the advances-to-deposit ratio (ADR) thresholds. Lastly, the shortfall in tax revenues from the target has widened,” it added.

The statement said that considering aforementioned developments, the MPC views the real policy rate remains appropriately positive to stabilise inflation within the target range of 5 to 7%.

All 12 analysts surveyed by Reuters expected a 200bps cut, after inflation fell sharply, slowing to 4.9% in November, largely due to a high base a year earlier, coming in below the government’s forecast and significantly lower than a multi-decade high of around 40% in May last year.

Monday’s move follows cuts of 150bps in June, 100 in July, 200 in September, and a record cut of 250bps in November, that have taken the rate down from an all-time high of 22%, set in June 2023 and left unchanged for a year.

It takes the total cuts to 900bps since June.

[ad_2]

Source link